|

Medium

|

Articles

Uncovering Value in Naming Rights Deals

Value Discovery Apr 29, 2019 - 4 min readContract Observations

Companies pay millions of dollars for the right to attach their names to professional and amateur sports arenas and stadiums and entertainment venues to connect with consumers. Typically, these naming rights contracts include an annual payment over a period of years. Some payments are fixed, others increase over the contract life. Only in unique instances are rare lump sum payments made or rights granted into perpetuity. The typical contract term is 10–20 years and includes payments ranging from hundreds of thousands to millions of dollars annually. The sum of these payments over the contract life are often referenced in media coverage and are used to rank the most expensive deals.

It is also common to see sponsor turnover. Not only at the end of a contract term, but early exits. We note that early exits have been triggered by sponsor bankruptcy, acquisitions or business lines changing away from consumer-facing products. It is also interesting to note that not all acquisitions result in an early exit. Some of the acquirers simply keep the contract and rebrand using their name.

Other contract provisions can include an option to extend the contract life, terminate early or to other sponsorship rights such as concession stands, vending, restaurants and lounges and even pouring rights to alcoholic and non-alcoholic beverages.

Many ask if these naming rights deals are worth the money spent. The answer is not clear. What is clear, short of any unusual circumstances such as a team leaving or the scheduled demolition of an old venue, are the factors driving demand in the recent deals we have reviewed.

Brand Building

A primary purpose behind paying for these rights is brand building. Naming rights offer some unique brand building opportunities over more commonly employed advertising and marketing campaigns.

Value Drivers

As expected, the data sample we reviewed points to deals involving professional teams as the most expensive and that value drivers are many, such as:

A Look at Recent Deals

The data sample in the period 2018-19 included 12 expired deals. All were renewed for the same venue, indicating that these deals are considered to have value. Two deals were extraordinary in nature. They were excluded from our review. One venue is scheduled to be demolished since the sports teams were relocated. The other deal exhibited an extraordinarily high increase in annual payments versus the expired deal. This leaves 10 deals.

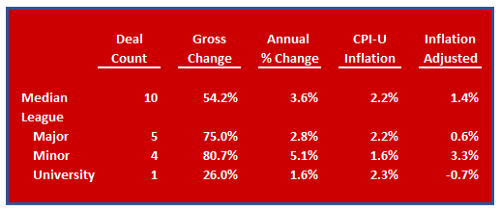

As another measure of value, we investigated the willingness to pay more to secure these rights by calculating the change in annual average contract payments. We calculated the change by relating the contracted payment amount of the new deal to the expired deal. Those results are included in Table 1.

Table 1

On a gross change basis, the median shows a substantial increase. This is interesting, but we also need to know if such change resulted from only inflation growth. To observe real price change, or to remove the effect of general inflation, the annual rate of inflation was subtracted from the annual rate of change measured over the expired contract term.

For the group, the median inflation adjusted price change was 1.4%. The Minor League sports team venues have enjoyed higher growth compared to the Major Leagues. In summary, it appears that the demand to acquire such rights remains and companies are willing to enter new contracts with higher payments. Empirically, it appears the naming rights contracts are worth the investment and existing contracts are more valuable given the advantage of below market contract payments.

More information:

https://fitsmallbusiness.com/tv-advertising/

https://fitsmallbusiness.com/tv-advertising/

Copyright© AUS Consultants, Inc.