|

Medium

|

Articles

Observed Royalty Rate Spreads Between Patented and Unpatented Technology

Value Discovery May 23, 2019 - 4 min readIntroduction

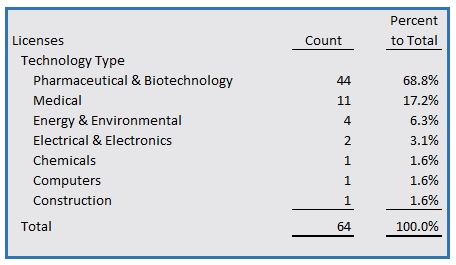

At RoyaltySource® we notice that sometimes a license specifies a different royalty rate for patented versus unpatented technology. Sometimes it is an implied differentiation — for example, if the licensed territory is worldwide and global patent protection is not available, the Licensor is willing to accept a lower royalty rate in recognition of the increased risk associated with no patent protection. We observed 64 licenses currently available in the RoyaltySource® royalty rates database that detail this royalty-rate spread. This article uses the 64 licenses in an analysis of royalty-rate differences based on whether the technology is patented. Table 1 shows their breakdown by technology type.

Table 1

The majority of the licenses grant rights to early-stage technologies in the area of pharmaceuticals, biotechnology and medical field in general. This is not surprising, since our database is heavy with technology licenses in these areas. In some of these licenses, the patented and unpatented technology were the same, but in all cases the unpatented technology appeared to be related or necessary to practice the patent rights.

Several of the licenses outlined royalty rates on sales of licensed products in patent-covered countries versus those in non-patent countries (the non-patent countries are characterized as locations where patents are pending, invalid, unenforceable, expired or not issued). Other licenses did not specifically discuss territories, or indicated lower royalty rates paid for technology of similar characteristics including know how, trade secrets and generic competition. These can be likened to patent rights in a nation that does not recognize them. Others simply specified a downward adjustment to the patent royalty rate.

Technology Overview

In general, the Pharma/Biotech license segment includes therapeutic and diagnostic technology-related licenses. The Medical-related technology license segment includes devices, equipment and supplies. The Energy/Environment category focuses on alternative, renewable and conventional energy technology. Image for post Discover more value insights here The Electrical/Electronic technologies include areas such as batteries, lasers, lighting, switches and power-management components. Chemical technologies cover composite materials, chemicals and plastics. The Computer licenses include computer components and the Construction segment covers construction/building materials and equipment.

License Characteristics

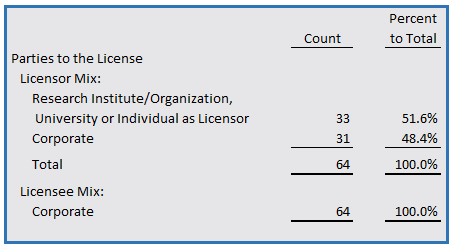

A further look into some of the license characteristics indicates that about half of the licensors are research-related organizations and the other half are corporations. All the licensees are represented by corporations (see Table 2).

Table 2

Many of the licenses granted lengthy terms or terms ending on the date of the last-to-expire patent. These long-lived rights are often granted in pharmaceutical/biotechnology-related licenses, since such rights are required to justify the large investment required to bring products to market.

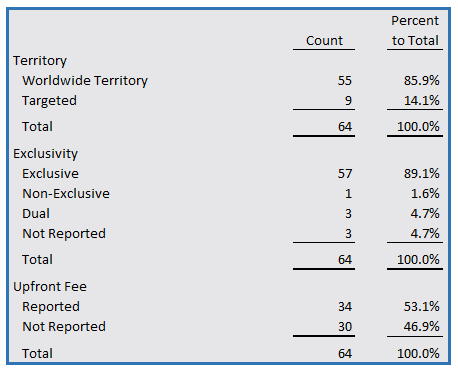

Table 3 summarizes the number of observations by Territory, Exclusivity and Upfront Fee. The overwhelming majority of the licenses granted exclusive worldwide territory rights and just over half of the reported upfront fees. These ranged from $12,500 to $5,000,000.

Table 3

The years of granting varies from 1992 to 2016. In each of the licenses, the royalty base was a measure of sales. Several of the transactions had a sliding scale or tiered royalty rate. This analysis accommodates multiple rates within a given license by including a total of 84 observations in the calculations.

Market Based Royalty Rate Spread Observations

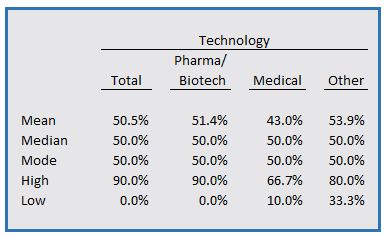

We observed the spread between the patented and unpatented technology royalty rate detailed within each license and divided that spread by the patent royalty rate to develop the percentage reduction. Table 4 presents the results of these calculations.

Table 4

The measures of central tendency point to a 50% reduction in the royalty rate of a license lacking the existence of a valid patent. In essence, this measure supplies a benchmark to develop royalty rate payments for unpatented technology, such as know how and trade secrets.

We can also characterize the inverse of this royalty rate reduction as a patent premium paid for the patent right to exclude others from the market. In other words, the percentage premium paid can be observed (1 minus the % royalty rate reduction) and then used to develop an indication of a patent royalty rate by dividing an unpatented royalty rate by the percentage premium. Copyright© AUS Consultants, Inc.