|

Medium

|

Articles

Magazine Subscriber Base Value Benchmark

Value Discovery Jun 29, 2019 - 4 min readIntroduction

The Value Discovery mission is to find and share market-based transaction data to help uncover asset value. In this article, we uncover transaction data and a market-based premium and use it to estimate Time Magazine’s print subscriber base value. However, the market-based premium can be applied to estimate or test value conclusions for any similar print subscriber base. The source of this information, that was found during our daily search for useful market benchmark transactions we report at Value Discovery, is an article published by "Digiday."

Valuation and Value Drivers

There is a wealth of information about discovering the value of a subscriber/customer relationship. One of the best sources offering a detailed discussion and practical examples is the Appraisal Practices Board’s Valuation Advisory #2: “Value of Customer-Related Assets.” The APB is an independent Board of The Appraisal Foundation.

In general, customer relationship value is dependent upon the amount of income earned from the relationship over the economic life of the relationship and the risk of achieving that income. Quantifying these factors form the basis for applying the income approach to value. The application of an income approach is typically preferred when valuing intangible property and many times this approach is used to support a market transaction. This means that the market and income approach can be related.

It is likely that the deeper the customer relationship, the more valuable the customer. For example, the relationship could be contractual or simply dependent on repeat patronage.

Print Subscriber Value

As stated earlier, an observed market-based premium will drive our analysis to discover the print magazine subscriber base value. We will present the data, calculate the value and suggest testing the conclusion.

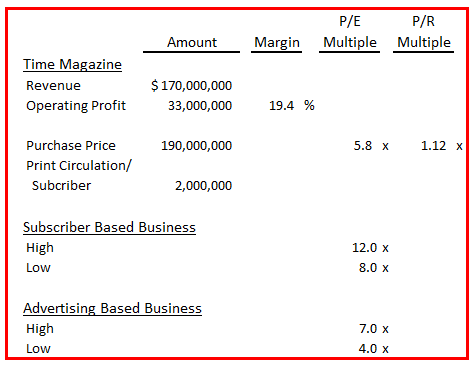

Source Data - Table 1 details basic purchase data. Time Magazine achieved a 19.4% operating profit margin and was sold at 5.8x operating profit and 1.12x revenue. If operating profit is a good proxy for EBITDA, the 5.8x operating profit multiple is below the low end of the 8x to 12x industry EBITDA multiples typically paid for subscription-based businesses. Time Magazine sold within the range of advertising only based businesses that currently indicate multiples of 4.0x to 7.0x EBITDA.

Table 1

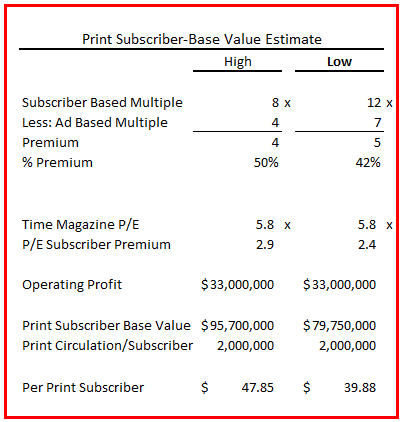

Value Development - The observed industry market multiple premium paid for a subscriber-based business versus an advertising-based business will serve as the starting point of our value calculation. Many will recognize this exercise as the “with and without method” approach to value. In other words, each business has the same complement of assets used to generate a return except for one asset and that asset contributes to an increased return. In this exercise, the market multiple premium attributable to the print subscriber base ranging from 42% to 50%, as shown on Table 2, is used to identify the print subscriber base value.

Table 2

The simple steps to calculate value begin by applying the market multiple premium paid to Time Magazine’s operating income to arrive at the print subscriber base value. The value indication ranges from $79.8 to $95.0 million or a per print subscriber value ranging from $39.88 to $47.85.

Ultimate Check

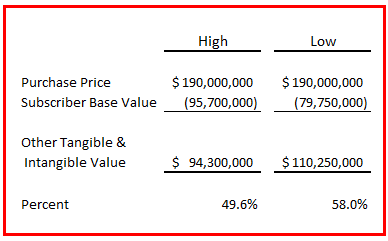

Ultimately, any subscriber base value estimate needs to be viewed in combination with the other assets assembled in the business that contribute to income. As a simple test, we will reduce the purchase price, assumed to be representative of the purchase consideration, to observe a lump sum residual representing the other tangible and intangible contributory asset value. The residual value can then be compared to typical industry residual value calculations.

Table 3

This calculation, detailed in Table 3, shows that the residual asset value ranges from 49.6% to 58.0%. If Goodwill represents 30%, is there room for the remaining value attributable to the other assets acquired such as the Time Magazine brand, advertising supported subscriber base, advertising relationships and tangible assets?

More Information

https://www.forbes.com/sites/tonysilber/2018/09/17/time-magazine-deal-is-latest-in-a-series-of-media-acquisitions-by-out-of-market-billionaires/#23dc23317064

https://digiday.com/media/time-magazine-deal-win-brand-digital-age/

https://www.appraisalfoundation.org/imis/TAF/Resources/Guidance/TAF/Valuation_Advisories.aspx?hkey=d74f24ae-8dcb-412e-947f-6df153626ae2

https://valuediscovery.royaltysource.com/about

Copyright© AUS Consultants, Inc.