|

Medium

|

Articles

Emerging Legal Cannabis Industry Growth Market Share

Value Discovery Jan 28, 2019 - 5 min readMarket Size and Growth

Asset valuations are influenced by many factors, including market size and growth. The wide range of worldwide cannabis market forecasts is an indication of the industry’s potential. There is little uncertainty surrounding the fact that a legal market is growing, and medical and recreational use will drive growth. Other markets, such as health, food and beverages are also anticipated to benefit.

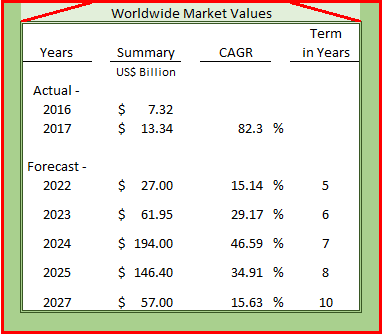

Recent forecasts of the 2017 worldwide market range from US$9.50 to 17.18 billion and average US$13.34 billion. This represents a 82.3% increase over the 2016 US$7.32 billion average estimate. While this growth is not sustainable, it is not unusual in an emerging market.

Longer term growth estimates over a 5- to 10-year term point to a slower, but still robust outlook — from a high of 46.6% for the seven years ending 2024 to a low of 15.1% for the five years ending 2022.

Recreational Cannabis Drives Market Value

Impacting the forecasts are the number of countries and U.S. states that will legalize recreational and medical uses. It is anticipated that recreational cannabis will be a primary growth driver. The largest market for recreational cannabis is anticipated to be North America, with two-thirds attributable to the United States. Current estimates of the U.S. market total US$23.3 in 2022 and US$52.2 in 2025. Canada legalized recreational use in October 2018.

Legalization Trend in the United States

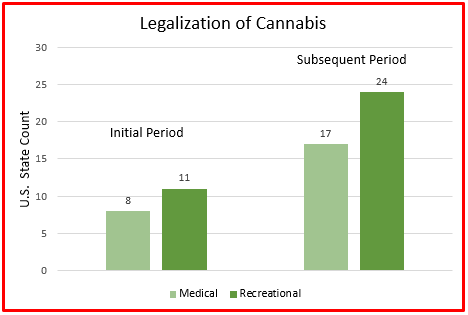

Uncertainty surrounding the success of expanding the legalization of recreational use likely contributes to the disparity in market value forecasts. A review of the historical medical cannabis legalization trend in the United States may help gain insight into these forecasts. The trend considers the 22-year period of approvals from 1997 to 2018 as a guide to future recreational legalization. The trend gives insight to qualitative factors such as behavioral and societal considerations that weigh the benefits and risks of legalization and the momentum behind the acceptance of these factors.

It appears that behavioral factors negatively impacting the approval of recreational use are less of a roadblock. Acceptance may be positively impacted by the successes attributable to medical use.

Summary Forecasts vs Estimates

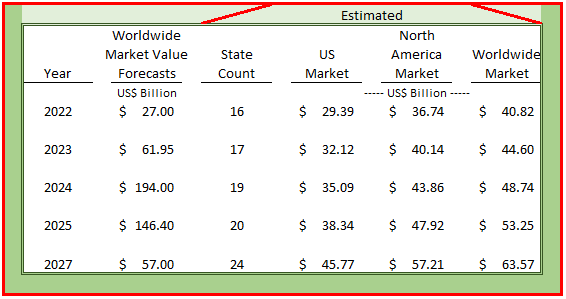

We will approximate, or estimate, the worldwide market size by using various inputs that may be incomplete or uncertain for comparison with these nascent market value forecasts. These estimates are based upon our estimate of the U.S. market value and adjust that value upward using North America and Worldwide market segment expansion factors. The estimates are summarized in Table 2. The U.S. market estimate considers an average State cannabis market size of US$1.875 billion and the number of states anticipated to legalize both recreational and medical cannabis use. The state average considers the 2017 California and Washington cannabis market sizes of US$2.75 billion and US$1.0 billion, respectively.

Using market segment forecasts for 2022, the U.S. and Canadian legal cannabis market could represent 90% of the world market. The U.S. is expected to garner 73%, Canada at 17% and the rest of the world will represent 10% of the legal cannabis market. Using these projections, the U.S. market is projected to represent 80% of the North American market.

These estimates help narrow the range of worldwide cannabis market forecasts to develop and evaluate prospective financial information for valuation purposes.

More information:

https://www.forbes.com/sites/thomaspellechia/2018/03/01/double-digit-billions-puts-north-america-in-the-worldwide-cannabis-market-lead/#4b9ba00d6510

https://www.industryleadersmagazine.com/cannabis-entrepreneurs-exploit-legal-loopholes-for-ip-protection/

https://business.financialpost.com/cannabis/cannabis-companies-race-to-clinch-an-edge-in-pot-industrys-next-phase-of-growth-intellectual-property

https://www.prnewswire.com/news-releases/global-cannabis-value-expected-to-keep-growing-as-north-america-dominates-the-market-882789930

https://www.grandviewresearch.com/press-release/global-legal-marijuana-market

https://www.mordorintelligence.com/industry-reports/cannabis-market

https://www.fool.com/investing/2018/10/17/just-how-big-will-the-marijuana-market-really-be.aspx

https://www.forbes.com/sites/thomaspellechia/2018/06/26/in-2017-beyond-u-s-enjoys-the-highest-legal-cannabis-market-share-worldwide/#4ba405ed2d20

https://www.businessinsider.com/legal-marijuana-states-2018-1

RoyaltySource Royalty Rates database www.royaltysource.com and www.ipscio.com

Copyright© AUS Consultants, Inc.