Welcome to the RoyaltySource® IP Data Guide

At RoyaltySource®, we maintain a database of intangible property licenses that report a royalty rate. These benchmarks are used in valuation, license negotiations, and transfer pricing assignments. Here in the RoyaltySource IP Data Guide, we will offer some insight, frequently asked questions, and proposed solutions offered over the past 20 years from RoyaltySource.Questions

Does RoyaltySource have general royalty rate industry data?

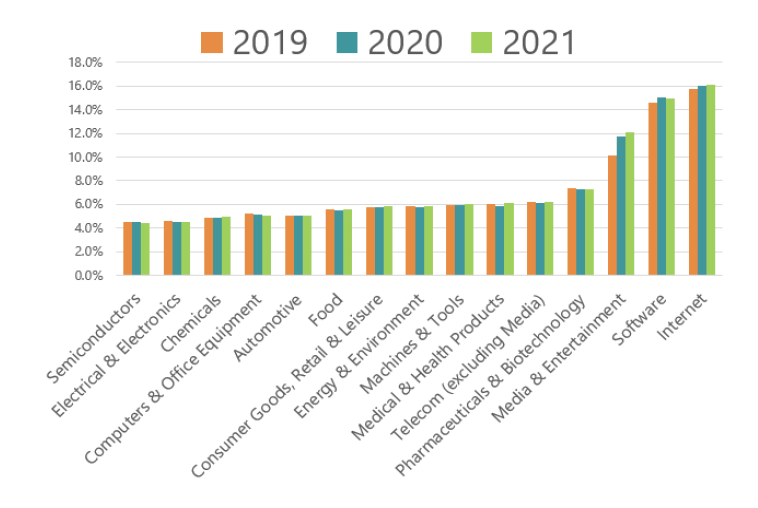

Yes, each year we prepare a Royalty Rate Industry Summary report that details composite technology royalty rate information for 15 industries

(which can been seen in the figure shown below). The following provides some information on how the report is compiled.

Average Royalty Rate by Industry

Detailed in the Figure below is a graphic presentation of the industry average royalty rates sourced from public documents and included in the summary. It is important to understand that in each year, the number of agreements used to prepare the graph is equal to the total number added to the RoyaltySource database up to that year.

While an analysis of industry royalty rates by vintage year would be a more appealing comparison to observe industry trends, the results would be difficult to interpret. Besides relying on just a few yearly observations that would have no statistical significance by any acceptable standard, the difficulty is a direct result of the various factors that influence royalty rates, such as the type of technology being licensed, the licensing activity in the industry, the scope of the license and the financial aspects surrounding the royalty payment.

It is evident that industry average royalty rates do not change much year-to-year, but there are significant differences between industries, indicating that a composite benchmark supplies good insight.

Why Look at Industry Composites

Touching on elements that influence the use of industry composite data is helpful in bringing greater transparency to selecting a royalty rate before or after completing a transaction or finalizing an opinion. Our list is not intended to be all-inclusive, but it is intended to jump-start the due diligence process needed to develop or test a conclusion.

Composite data offers:

1. A view of the overall market and industry sector trends over time.

2. Observations averaged together form a general statistic representative of the economic impact of license clauses and royalty payment structures. For example, the scope of a license includes clauses such as:

License Grant

Exclusivity

Territorial Restrictions

Duration, Renewals, Termination

Ownership Rights to New Developed Technology

Monitoring and Quality Control

These license clauses influence royalty payments, yet their impact may be unknown or difficult to measure. The mix of royalty payment structures also influences the magnitude of a royalty payment. The royalty payment can be split between various payment methods such as:

Upfront fees, milestone payments, stock issuances

Royalty — lump sum, running royalty, defined amounts, minimums, etc.

Required purchases of supporting services or materials

Sharing of costs, etc.

A composite look considers these influences.

3. Direction and/or a check against a detailed analysis. For example, how do you know if your conclusion makes sense? If your conclusion appears to be “out-of-bounds” compared to a composite, more due diligence is needed and/or a detailed explanation of why your conclusion is outside the bounds. This check will likely cultivate a better report for audit or court.

4. Supplying a useful benchmark against which to measure Intellectual Property portfolio performance to help answer questions such as (1) are we under pricing or overpricing our technology and (2) what is the licensing activity in our industry segment?

Applying Industry Composites in Practice

Just knowing the boundaries of market-based royalty rates and deal terms for your target Intangible Property, prior to a more in-depth search and analysis, gives support for various purposes. These include:

1. Transactions — Licensing and purchase/sale of IP transactions. Licensing executives can quickly control compensation expectations by establishing a playing field, or a range of royalty rates/values, prior to and during negotiation.

2. Litigation — Infringement damage litigation has become so expensive that the parties to the matter can quickly assess possible damage awards before moving forward to make sure the choice to litigate or settle is economically feasible.

3. Financial Reporting — Experts performing purchase price allocations under IFRS 3/ FASB ASC 805 need to select a royalty rate when using the relief-from-royalty approach to Intangible Property valuation. Selection of a comparable royalty rate begins with assembling supporting documentation for the selection of a royalty rate. A broad view of royalty rate benchmarks and a follow-on targeted search to make a judgement will strengthen the analysis and supporting documentation under audit review.

4. Taxation — Transfer Pricing experts can quickly test inter company agreements by using benchmark royalty rate data and the interquartile range.

The 2021 Royalty Rate Industry Summary is now available for purchase.

please click on the following link: https://selfserve.royaltysource.com/royaltyrateindustrystudy/

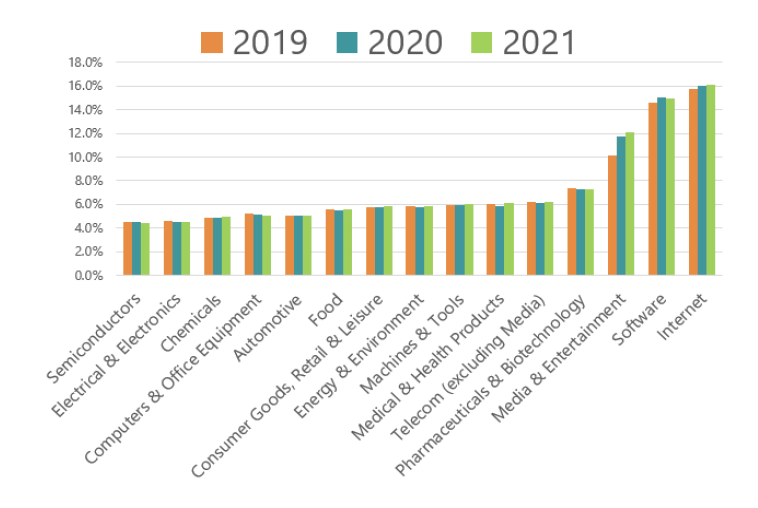

Average Royalty Rate by Industry

Detailed in the Figure below is a graphic presentation of the industry average royalty rates sourced from public documents and included in the summary. It is important to understand that in each year, the number of agreements used to prepare the graph is equal to the total number added to the RoyaltySource database up to that year.

While an analysis of industry royalty rates by vintage year would be a more appealing comparison to observe industry trends, the results would be difficult to interpret. Besides relying on just a few yearly observations that would have no statistical significance by any acceptable standard, the difficulty is a direct result of the various factors that influence royalty rates, such as the type of technology being licensed, the licensing activity in the industry, the scope of the license and the financial aspects surrounding the royalty payment.

It is evident that industry average royalty rates do not change much year-to-year, but there are significant differences between industries, indicating that a composite benchmark supplies good insight.

Why Look at Industry Composites

Touching on elements that influence the use of industry composite data is helpful in bringing greater transparency to selecting a royalty rate before or after completing a transaction or finalizing an opinion. Our list is not intended to be all-inclusive, but it is intended to jump-start the due diligence process needed to develop or test a conclusion.

Composite data offers:

1. A view of the overall market and industry sector trends over time.

2. Observations averaged together form a general statistic representative of the economic impact of license clauses and royalty payment structures. For example, the scope of a license includes clauses such as:

These license clauses influence royalty payments, yet their impact may be unknown or difficult to measure. The mix of royalty payment structures also influences the magnitude of a royalty payment. The royalty payment can be split between various payment methods such as:

A composite look considers these influences.

3. Direction and/or a check against a detailed analysis. For example, how do you know if your conclusion makes sense? If your conclusion appears to be “out-of-bounds” compared to a composite, more due diligence is needed and/or a detailed explanation of why your conclusion is outside the bounds. This check will likely cultivate a better report for audit or court.

4. Supplying a useful benchmark against which to measure Intellectual Property portfolio performance to help answer questions such as (1) are we under pricing or overpricing our technology and (2) what is the licensing activity in our industry segment?

Applying Industry Composites in Practice

Just knowing the boundaries of market-based royalty rates and deal terms for your target Intangible Property, prior to a more in-depth search and analysis, gives support for various purposes. These include:

1. Transactions — Licensing and purchase/sale of IP transactions. Licensing executives can quickly control compensation expectations by establishing a playing field, or a range of royalty rates/values, prior to and during negotiation.

2. Litigation — Infringement damage litigation has become so expensive that the parties to the matter can quickly assess possible damage awards before moving forward to make sure the choice to litigate or settle is economically feasible.

3. Financial Reporting — Experts performing purchase price allocations under IFRS 3/ FASB ASC 805 need to select a royalty rate when using the relief-from-royalty approach to Intangible Property valuation. Selection of a comparable royalty rate begins with assembling supporting documentation for the selection of a royalty rate. A broad view of royalty rate benchmarks and a follow-on targeted search to make a judgement will strengthen the analysis and supporting documentation under audit review.

4. Taxation — Transfer Pricing experts can quickly test inter company agreements by using benchmark royalty rate data and the interquartile range.

The 2021 Royalty Rate Industry Summary is now available for purchase.

please click on the following link: https://selfserve.royaltysource.com/royaltyrateindustrystudy/